The Government vs. Google – what’s going on?

Google and Facebook are the largest digital and search platforms platforms by far, with over a third of UK internet users’ time online spent on their sites. Google has more than a 90% share of the £7.3 billion search advertising market in UK, while Facebook has over 50% of the £5.5 billion display advertising market. Both companies have been highly profitable for many years.

Both Google and Facebook grew by offering better products than their rivals. However, they are now protected by such strong incumbency advantages – including network effects, economies of scale and unmatchable access to user data. The CMA (Competition and Markets Authority) feels that potential rivals can no longer compete on equal terms and says that these issues matter to consumers. Their view is that weak competition in search and social media leads to reduced innovation and choice and to consumers giving up more data than they would like.

Faced with these views, in July 2020 the Competition and Markets Authority (CMA) published a report which noted that Google and Facebook had a high degree of market power in their respective markets, with consumers facing substantial harm as a result, and that the statutory test for making a market investigation reference had been met across a number of related markets. However, their provisional view was that they should not launch a market investigation on the basis that recommendations to government for regulatory reform represented the best means of addressing the concerns.

The main issue is that there is a substantial lack of transparency that has the potential to create or exacerbate a number of competition problems. Platforms with market power have the incentive and ability to increase prices, for example, or to overstate the quality and effectiveness of their advertising inventory. They can take steps to reduce the degree of transparency in digital advertising markets, reducing other publishers’ ability to demonstrate the effectiveness of their advertising and forcing advertisers to rely on information and metrics provided by those platforms. And the lack of transparency undermines the ability of market participants to make the informed decisions necessary to drive competition. The upshot of all of these issues is that competition is weakened and trust in the market is eroded.

By expanding the breadth and variety of online services provided, Google and Facebook are able to gather increasing amounts of the two critical inputs to the digital advertising market: consumer attention and data. This in turn results in greater advertising revenues, enabling them to invest at a greater rate than their rivals, which creates a feedback loop that further cements their powerful position.

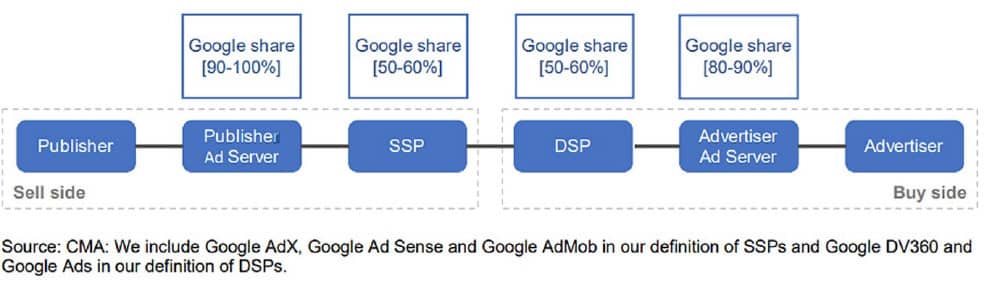

Publishers have expressed concerns about the extent of vertical integration that has taken place in the open display market. While vertical integration can allow intermediaries to realise technical efficiencies, it can also give rise to conflicts of interest and allow companies with market power at one stage of the value chain to use it to undermine competition at other stages. Specifically, Google, (see diagram below) has a very strong position in advertising intermediation in the UK, controlling a share of [90-100]% of the publisher ad server segment, [80-90]% of the advertiser ad server segment and shares of [50-60]% in supply-side platforms (SSPs) and [50-60]% in demand-side platforms (DSPs).

In addition, in relation to the auctions used to sell advertising inventory, for example, platforms have considerable discretion over a wide variety of parameters that affect the prices advertisers pay, including how relevance is assessed and the level of reserve prices (which determine the price paid in over half of the auctions in Google Ads). Further, for the substantial majority of advertisers which make use of platforms’ automated bidding tools, platforms even have discretion over which auctions advertisers participate in and the level of their bid. Over 90% of UK advertisers on Facebook use the default automated bidding feature, which does not allow advertisers to specify a maximum bid.

The main data-related interventions that were assessed in the study, and which have been considered as being necessary as part of the assessment toolkit, are the following:

- Increasing consumer control over data, which includes providing choices over the use of data and facilitating consumer-led data mobility;

- Mandating interoperability to overcome network effects and coordination failures;

- Mandating third-party access to data where data is valuable in overcoming barriers to entry and expansion and privacy concerns can be effectively managed; and

- Mandating data separation/data silos, in particular where the data has been collected by the platforms through the leveraging of market power.

The CMA also thinks there is a strong case for the power to introduce separation and access interventions in the open display market. The strong position of Google’s publisher ad server, SSP and DSP, and its unique access to Google’s ad inventory, means that each of these businesses potentially faces a conflict of interest, potentially acting on the advertiser side, on the publisher side and on Google’s own account. Further, Google can increase its market power by combining access to YouTube to use of its DSP services. Based on this analysis, it is considered that there is a case for two broad forms of intervention to address these concerns in open display advertising:

- Separation of the function of ad serving from the advertising advisory function (DSP), where the ad server has market power; and

- The prohibition of a DSP restricting access to its inventory, where that inventory is sufficiently important to generate market power for the DSP. The DMU (Digital Markets Unit, proposed as the legislating body) should have powers to implement ownership separation and operational separation and to oblige parties to provide access to inventory on reasonable terms.

Throughout the market study the CMA has engaged extensively with other international authorities. This includes discussions with: authorities in countries undertaking similar market studies into digital advertising, including France, Germany and Sweden; countries developing proposals for ex-ante regulation of platforms, including Australia, Germany and Japan; and authorities that have recently completed or have ongoing enforcement investigations in relation to digital advertising, including authorities in the United States and the European Commission.

The CMA recommendations to the government say that they should legislate to introduce a new regulatory regime for platforms comprising both the code and the pro-competitive interventions, drawing on the work of the CMA into online platforms funded by digital advertising, and that of the Digital Markets Taskforce, which will also be considering online platforms funded by transactions.

More specifically, the CMA make the following high-level recommendations to government for what this legislation should include:

Recommendation 1: Establish an enforceable code of conduct to govern the behaviour of platforms funded by digital advertising that are designated as having strategic market status (SMS). The purpose of the code would be to meet three high-level objectives of fair trading, open choices and trust and transparency.

Recommendation 2: Establish the requirement for a DMU to undertake SMS designation, introduce and maintain the code based on objectives set out in the legislation, and produce detailed supporting guidance.

Recommendation 3: Give the DMU the necessary powers to enforce the principles of the code on a timely basis, and amend its principles in line with evolving market conditions.

Recommendation 4: Give the DMU the necessary powers to introduce a range of pro-competitive interventions, which should include: a. Data-related interventions (including consumer control over data, interoperability, data access and data separation powers) b. Consumer choice and default interventions c. Separation interventions.

It is fair to say that these recommendations, if implemented, would have a big impact on how agencies plan, buy and sell digital advertising.

At LAW, we will do our best to keep you up to date with developments. From our point of view, it’s worth remembering that Google Search is a massively important tool worldwide and, more importantly, is free. Advertisers don’t really care about the cost as long as it makes them more than they paid. So, in trying to unpick or over regulate the market, the governments of the world have to be careful that they don’t kill the golden goose. A fragmented, unjointed system of handling social and search functions is in nobody’s interest, least of all that of the public.

Sometime In 2021 the government will consult on these reforms but is currently broadly supportive of them and in all probability they will be passed into law.

If you have an opinion about this topic, please get in touch with Brett Sammels at LAW Creative and we’ll keep the debate going.

Sources: mainly edited from the CMA Report dated July 1 2020

Government response: gov.uk/government/publications/government-response-to-the-cma-digital-advertising-market-study/html